Option Geeks Stock Market

What is Option Geeks in Stock Market

Options Traders often talk about the Delta, Gamma, Vega, Theta of their option premium, collectively known as the ‘Greeks’ of the premium but most traders perhaps, seldom know what are these greeks anyways and more importantly, what can these do for you? Read on and we will learn how options are priced, How implied volatility, time to expiry, strike price and spot price influence the change in option premium.

Greeks are a way to measure the sensitivity of the price of the option to various factors. The price of the option premium does not always move in conjunction with the price of the underlying asset and hence it is important to understand the different factors that contribute to the change in the price of the premium.

How will the greeks help you?

There are a total of 5 option greeks, each impacting the change of option premium differently. Every option will have these key parameters that are used in calculating the greeks.

Strike price: The price at which the buyer and the seller of an option have agreed to enter the option contract.

Premium: The payment made by the buyer to the seller to earn his right to an option contract.

Expiration day: The last day that the option owner can exercise the right.

Delta Greek

Delta (Δ) can be used to measure the sensitivity of an option’s price changes relative to the changes in the underlying asset’s price. In other words, if the price of the underlying asset increases by 1 point, the price of the option will change by Δ amount. Mathematically, the delta can be calculated by using the formula below;

- ∂ — the first derivative

- V — the option’s price (theoretical value)

- S — the underlying asset’s price

Gamma Greek

Gamma (Γ) is used to measure the delta’s change relative to the changes in the price of the underlying asset. If the price of the underlying asset increases by 1point, the option’s delta will change by the gamma amount. The gamma can be calculated by using the formula below:

Vega Greek

Vega (ν) is an option Greek that measures the sensitivity of an option price relative to the volatility of the underlying asset. If the volatility of the underlying asses increases by 1%, the option price will change by the vega amount. The vega can be calculated by using the formula below: Where

- ∂ — the first derivative

- V — the option’s price (theoretical value)

- σ — the volatility of the underlying asset

>The vega is expressed as a monetary amount rather than as a decimal number. An increase in vega generally indicates an increase in the option value.

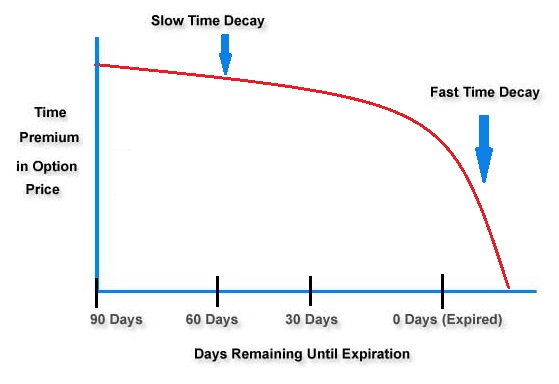

Theta Greek

Theta (θ) is a measure of the sensitivity of the option price relative to the option’s time to maturity. As the time to maturity of an option changes(decreases each day), the option premium will change by theta amount. The Theta option Greek is also referred to as time decay. It can be calculated by using the formula below; Where

- ∂ — the first derivative

- V — the option’s price (theoretical value)

- τ — the option’s time to maturity