Theta Greek Stock Market

What is Theta Greek in Stock Market

Theta (θ) Greek is a measure of the sensitivity of the option price relative to the option’s time to maturity. As the time to maturity of an option changes(decreases each day), the option premium will change by theta amount. Theta also known as Time Decay. The Theta option Greek is also referred to as time decay.

Theta options are defined as an options greek that measures the rate at which the option loses its time value as the expiration date draws near. It can be calculated by using the formula below;

- ∂ — the first derivative

- V — the option’s price (theoretical value)

- τ — the option’s time to maturity

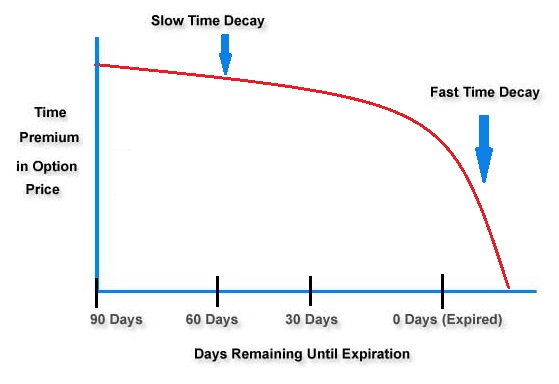

Theta represents, in theory, how much an option's premium may decay each day with all other factors remaining the same. Options lose value over time. The moment that the contract is created, time valueHover to view help pop-up begins to deplete. The loss in time value of near-the-moneyHover to view help pop-up options accelerates as the expiration date approaches. This is a representation of Theta's behaving in a nonlinear fashion.

Higher Theta is an indication that the value of the option will decay more rapidly over time. Theta is typically higher for short-dated options, especially near-the-money, as there is more urgency for the underlying to move in the money before expiration. Theta is a negative value for long (purchased) positions and a positive value for short (sold) positions – regardless if the contract is a call or a put.